sale of goods act 1957 cases

But in some cases GST is to be collected by the purchaser of goodsservice and not by seller. Negotiable paper given as price of liquor illegally sold if transferred after due is void.

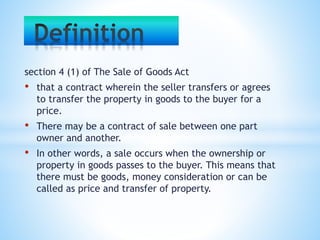

Sale Of Goods The Sale Of Goods Act

The Consumer Credit Act 1974 is an Act of the Parliament of the United Kingdom that significantly reformed the law relating to consumer credit within the United Kingdom.

. General insurance business has the meaning assigned to it in clause g of section 3 of the General Insurance Business Nationalisation Act 1972 57 of 1972. Such cases are not called reverse charge. This Act may be cited as the Defamation Act 1957.

5 6 Eliz. Schedule 6 except for cases in which the value of goods falls to be determined as at a time before the entry date. List of Goods under RCM in GST.

The Customs and Excise Act 1952. Tax suspended for one week in August for sales of clothing or footwear of less than one hundred dollars. LIQUOR CONTROL ACT The following cases decided prior to enactment of the Liquor Control Act of 1933.

Since introduction of GST the Central Government has notified a number of goods and services us 93 of CGST Act for the purpose of levy of GST under reverse charge mechanism. In this Act unless the context otherwise requires-- broadcasting by means of radio communication means publication for general reception by means of a radio communication within the meaning of the Telecommunications Act 1950 Act 20 and includes the transmission. In this article we are discussing such goods and services which have been notified by the Central Government for the purposes of RCM.

The Iron and Steel Act 1953. Plaintiffs liquors kept for illegal sale were attached and removed as goods of another party. The Customs Act 1962 Act for short provides for penalties.

Nothing in this Act applies to the sale supply or keeping for sale or supply of alcohol in a a canteen or mess or any other place in a naval ship or defence area within the meaning of section 21 of the Defence Act 1990 where the consumption and possession of alcohol is authorised by or under the Defence Act 1990 or by the Chief of. 50 goods has the meaning assigned to it in clause 7 of section 2 of the. Section 114 Penalty for attempt to export goods improperly etc.

In some cases of sale through E-commerce operator such as Uber ola etc the tax is not collected and deposited by seller but collected by e-commerce operator. 1 2 Eliz. A1 From the third Sunday in August until the Saturday next succeeding inclusive during the period beginning July 1 2004 and ending June 30 2015 the provisions of this chapter shall not apply to sales of any article of clothing or footwear intended to be worn.

This is called Reverse Charge Mechanism RCM in short. Chapter XIV of the Act provides for imposition of penalties. Section 26b with the preceding.

The following sections dealt with imposition of penalties-Section 112 Penalty for improper importation of goods etc. Section 114A Penalty for short levy or non levy of duty in. Prior to the Consumer Credit Act legislation covering consumer credit was slapdash and focused on particular areas rather than consumer credit as a whole such as moneylenders and hire.

The Agriculture Act 1957.

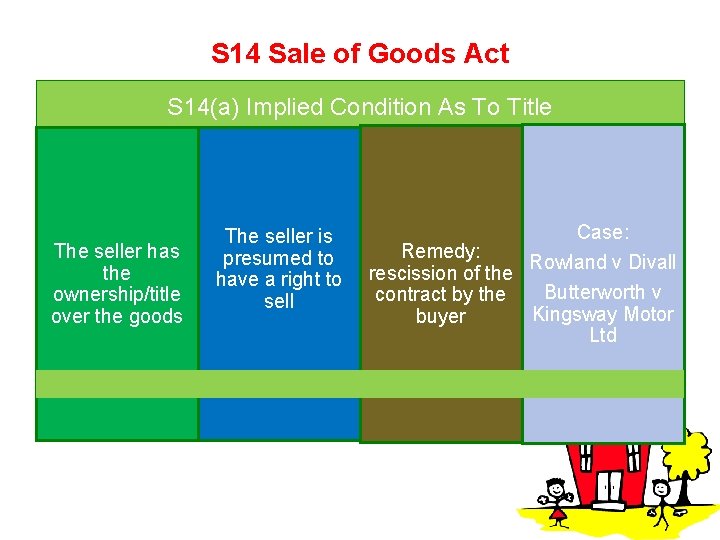

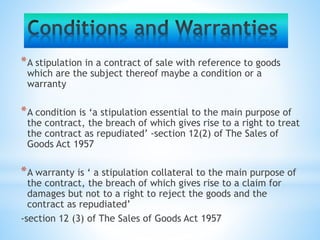

Implied Conditions And Warranties Under The Sale Of Goods Act Ipleaders

Sale Of Goods The Sale Of Goods Act

Sale Of Goods The Sale Of Goods Act

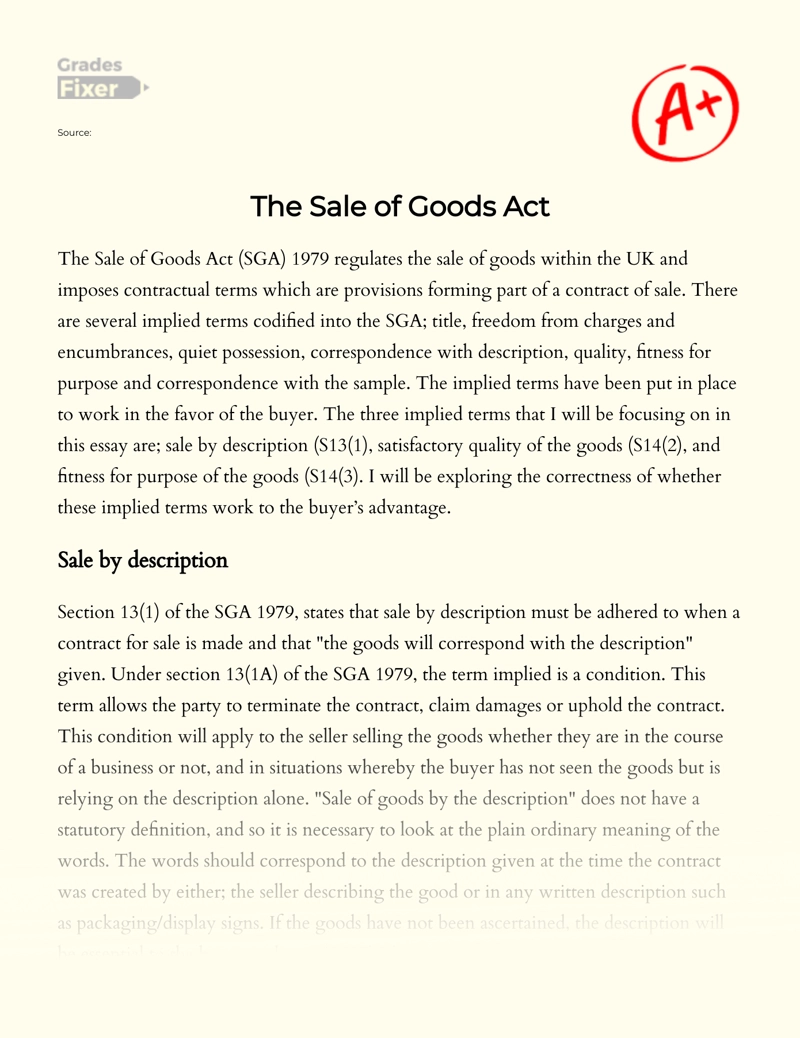

The Sale Of Goods Act Essay Example 2668 Words Gradesfixer

Business Law Sales Of Goods Act Case Studies

Business Law Sales Of Goods Act Case Studies

Doc Business Corporate Law Sale Of Goods Dr Seow Hock Peng Academia Edu

Sale Of Goods The Sale Of Goods Act

Sale Of Goods The Sale Of Goods Act

Sale Of Goods Act Law446 Studocu

Sale Of Goods The Sale Of Goods Act

No comments for "sale of goods act 1957 cases"

Post a Comment